May mga pagkakataon na gusto natin as a trader na ma-anticipate kung nasaan ang top and bottom ng market, and we are looking for a trend reversal patterns for high probability trading.

Bago tayo pumasok sa trade, tinatanong muna natin sa ating mga sarili.

Is this the bottom?

is this the top?

Should I enter now? Or should I wait?

Kung ganyan ang mga katunungan mo, malamang na hindi ka sigurado sa gagawin mo.

Pero may chance ba talaga na matimingan natin ang tops and bottom ng market?

Ang sasabihin ng karamihan ng mga traders, there is no way that we can accurately find the tops and bottoms of the market.

Ganyan din ang mindset ko noon.

Pero mayroon akong natuklasan na paraan na nagpabago sa paniniwala ko.

And there is actually a way, na malaman natin ang tops and bottom ng market.

This is almost accurate and one of the high probability tradings set-up out there.

Now, I will share it with you.

Ang tinatago ng mga professional traders na ayaw nila ipaalam sa inyo.

But before that, bakit ba natin inaalam ang tops and bottom ng market?

Dahil sa malaking profit na makukuha natin dito. Gusto natin mag ride sa trend sa simula pa lang, at malaman kung saan mag sisimula ang trend reversal.

Pero hindi lang ito dahil sa profit, parte din ito ng risk management.

Kasi makakapag exit tayo ka agad, if we know that this is the top of the market.

And a possible trend reversal is just around the corner.

Speaking of trend reversal, ano ba ang ginagawa nang karamihan para ma identify ang possible trend reversal?

Candlestick trend reversal? Good!

Support and resistance? Good!

Trendline, Fibonacci retracement, They are all good!

But the things is, hindi lahat ng trader alam yan, at may iba’t- iba silang approach sa trend reversal.

Kadalasan ganito.

Kapag nag dump ang market, its time to buy!

Sabi nga nila

“Be fearful when others are greedy and greedy when others are fearful“

Yeah, I know, I know. Pero ang kasabihan na ito ay hindi angkop sa lahat ng pagkakataon,

kailangan natin timbangin ang takbo ng market.

Kasi when the market goes down, iniisip natin ito na yung bottom, and we are expecting for an uptrend.

And we don’t want to miss the big trend.

Pero paano kung hindi at magtuloy tuloy ito sa pagbaba?

There is a reason why the price is plummeting, and you have to wait for a sign of reversal.

At kung magkaroon man nang reversal katulad ng trendline breakout, still observed.

Kasi possibleng ito ay false break out at hindi legit na breakout.

It could be a temporary correction sa pagpapatuloy ng down trend.

Kaya be very careful sa first pullback maraming nabibiktima dito dahil na rin sa fear of missing out.

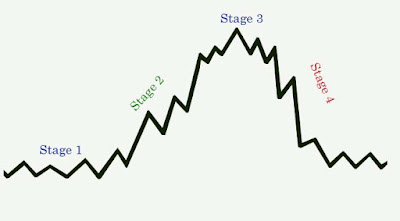

4 Stages of Market cycle

Bago tayo pumunta sa strategy , kailangan muna natin maunawaan ang consepto ng market cycle.

Ito ang magbibigay sa atin ng sign ahead of time, kung may pagbabago ba na nagaganap sa market condition.

Kung matagal ka nang nag tetrade, I am pretty sure na familliar ka na dito. Madalas lang ito nag kalat sa mga articles, trading forum, Facebook group etc.

Pero iilan lang ang nakakaunawa dito at ginagamit ito sa kanilang trading style.

At dahil nagbabasa ka ngayon dito, you will be informed.

May apat na stages ang market

- Accumulation stage

- Advancing stage

- Distribution stage

- Declining stage

Accumulation stage

Ang accumulation stage ay nangyayari sa dulo ng downtrend market.

Ang galaw ng price dito ay nasa trading ranges or moving sideways. Hindi ganoon kalalaki ang mga candlestick at halos magkasing dami lang ang bearish and bullish candles.

Let say for example sa daily chart and we normally use a 50-day moving average.

Ang 50 day moving average dito ay flat kasi naglalaro lang up and down ang price dito.

Walang assurance na mag rereverse na ang market

But this could be a sign na mahina na ang bear side at malapit ng makontrol ng bulls ang market.

At kung magkaroon man ng reversal pupunta tayo sa next stage.

Advancing stage

Dito na yung stage kung saan makakakita tayo ng higher high sa chart. Mas malakas ang buyer side kaysa sa seller side. Bulls are in control.

Mas maraming bullish candles stick at mas mahahaba ito kaysa bearish candles.

Ang price ay nasa ibabaw ng 50-day moving average at naka point ito upward.

A good example of an uptrend market.

Pero ang stage na ito would not last forever.

Kasi ang mga traders na nag enter ng mas maaga sa market will take profits.

And they will start selling soon. That would end up in the next stage.

The distribution stage

Ano ang nangyayari sa distribution stage?

Babalik tayo sa ranging market, pero this time ito ay nangyayari sa uptrend market.

Parang sa accumulation stage lang ito.

Ang dami ng bullish at bearish candles ay halos mag kaparehas lang. They are fighting each other.

Ang price ay tumatakbo sideways sa 50 moving average.

Pero it doesn’ t mean na mag rereverse na ang market sa stage na ito.

However, there is a posibility, so kailangan maging alerto tayo sa sitwasyon kung nakokontrol na ba ng bear side ang market, at nag papakita na nang weakness ang bull side.

The declining stage

Paano natin masasabi kung nasa downtrend na tayo?

Ang takbo ng chart ay pababa na nag coconsist ng lower high, at lower low.

Mas marami ang bearish candles kaysa bullish candles.

Ang price ay nasa ilalim na ng 50 day moving average at naka position ito downward.

Syempre ang stage na ito ay hindi din naman pang habang buhay.

Ang mga traders na nakapag enter ng short position ng maaga, will take profits. Mapapansin ng ilang mga traders at investors na mababa na ang price and they will start putting a long position.

And we will go back to accumulation stage again.

Remember, ang market ay cyclical.

Identifying a reversal

Ngayon may idea na tayo sa takbo ng market.

Madali na lang natin mahahanap kung saan possibleng mag reversed ang market.

So where it is?

During accumulation stage and distribution stage.

And we have to identify these two playing on a support and resistance level sa higher time frame at lower time frame.

What do I mean by that?

Let me further explained.

Halimbawa, nasa downtrend market tayo and it enters an accumulation stage.

May dalawang bagay tayong kailangan makita.

- Nasa support level ba ito ng higher time frame? (1 day)

- May accumulation stage ba na nagaganap sa lower time frame? (1 hr)

Here’s an example:

Daily chart

1 hr chart

As a rule of thumb.

Kung ang support level ay nasa daily time frame, ang accumulation stage na hahanapin natin ay nasa 4 hrs or 1 hr time frame

Kung ang support level naman ay nasa weekly time frame, ang accumulation stage na hahanapin natin ay nasa daily chart at 4 hr chart.

For short position naman, you get the idea, you have to look for a resistance level sa higher time frame and distribution stage sa lower time frame.

How to enter a trade on trend reversal patterns?

Na cover ko na ito sa ibang article, kung hindi nyo pa ito nababasa you may go here.

For a quick overview

The best way to enter a trade ay sa area ng support and resistance, pullback, Fibonacci retracement, and trend line break out.

Para stop loss at exit point naman.

It may depends on your risk management and trading strategy.

You can ride a trend as long as you want, or you may just catch the swing.

There is no right or wrong. Ang purpose ng article na ito ay para ma identify ang possibleng tops and bottoms ng market with high accuracy.

What are the benefits kung maidentify mo agad ang top and bottom ng market?

You can enter early and exit early with a huge profits.

That’s what we want right?

Once again, kung may natutunan kayong bago leave a comment below and don’t forget to share this with your friends and people who want to learn how to trade.

Happy trading!

Very informative and helpful po.. Salamat ng Marami

Salamat sa pag bisita at pag babasa.

Salamat ng marami sa free informasyon na ito.

Thanks sir,karagdagang aral to para sakin na baguhan sa pag ttrade.God bless.

Laging kong binabalikan mga articles nyo po…sana di po kayu magsawa..

maraming salamat po

Thank so much sir, ikaw lng ata me article na ganito. Un sinalihan kong me bayad na 6,997. Sbi me ebook wala nman pala. Forecast lng binigay. Syo free. I will surely read all your articles. I already watched most of your videos. God bless you more.

Pingback: Paano Mag Trade ng Walang Indicators? (Price Action Trading Explained) – Altcoinpinoy